Apartment Bond Program

Reduce risk, get more tenants, increase profitability

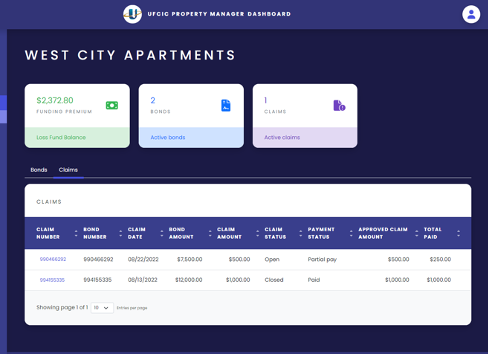

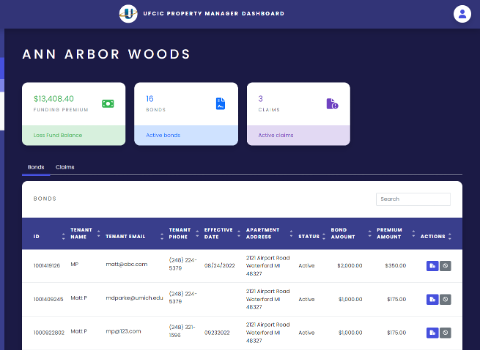

Give your tenants an alternative deposit option to lower move-in costs while eliminating the need for your administrators to handle traditional security deposits. Tenants pay a one-time premium for a bond amount that is equal to the security deposit amount. Our financial technology supports the online processing of the bond premiums, the total funding amount, payments, and collections.

Get More Tenants, Lower Move-In Costs

- Get the same protection as traditional security deposits

- Quick and easy online process for tenants

- Customized marketing material per apartment

- No Minimums on the number of apartments required to launch the program

- UFCIC administers the entire process without an agency allowing you to have a higher funding percentage and controllable premium rates per apartment.

Frequently Asked Questions

These financial agreements are used in place of traditional security deposits. The Principal (you) pays the Surety (Insurance Company) a small premium to get access to the insurance company’s creditworthiness up to the Bond Amount (Security Deposit). This bond guarantees the Obligee (Property Company) that it will not suffer financial loss due to your negligent behavior such as damaging an apartment beyond normal wear and tear or not paying rent.

The bond costs 17.5% of the bond amount (the security deposit amount). This is a one-time charge for the length of your tenancy. In other words, you pay a small amount now instead of having thousands of dollars tied up in a security deposit. The cost is on per apartment basis, so if you have roommates, splitting the cost of the bond lowers the individual cost.

If no damage or unpaid rent has accrued, your obligations under the bond are completed. Your property manager can provide confirmation of this after you move out.

If you have caused damage or have unpaid rent, the property company has a right to be indemnified for any losses up to the bond amount. If your bond amount is $1,000, you can be subject to claims up to that amount. You will have to pay for these charges if you are liable.

No, the premium is not returned because it is a fee used to obtain the surety bond. This is a one-time charge and only costs a fraction of the security deposit.

More Information on this service

Fast

Easy

Secure

Universal Fire & Casualty Insurance Company (UFCIC)

UFCIC has partnered with property complexes to provide a more practical solution for security deposits. Through conversations with property managers and tenants, the Apartment Surety Bond Program has become the favored solution to get tenants into the apartment they want with the protection the property complex requires. No longer will you be required to deposit thousands of dollars, held for the length of your tenancy, in order to get into the apartment you desire.

Universal Fire & Casualty Insurance Company (NAIC No.32867) has been providing surety bonds for over 20 years across the majority of the United States. UFCIC is AM Best “A-“rated, Treasury Listed, and rated “A Exceptional” by Demotech. We have offices located in Waterford, MI and Dublin, OH. You can speak to a representative by calling 616-662-3900 during normal business hours.