DUBLIN, OHIO, UNITED STATES, July 16, 2024 – Universal Shield Insurance Group (Universal Shield), a leading provider of innovative commercial insurance and technology solutions, is pleased to announce the appointment of Don DeMent as Vice President of Marketing, Distribution, and Field Underwriting. With over two decades of experience in the Commercial Excess & Surplus industry, DeMent brings a wealth of knowledge and expertise to this crucial role. His impressive career spans key roles with insurance carriers and wholesale organizations including roles in underwriting, operations management, business distribution, and marketing. DeMent’s expertise extends beyond traditional insurance roles, encompassing data analysis, platform […]

WATERFORD, Michigan – April 23, 2023 – Universal Shield Insurance Group (Universal Shield) is proud to announce the introduction of its proprietary Business to Business (B2B) Surety Bond Distribution System – Bond Ramp. The introduction of this new platform brings a modern and efficient approach for insurance and surety producers, with limited and extensive surety books, to underwrite and instantly place bonds for the many professions that require bonds. Bond Ramp further provides a fast, efficient, and profitable way to build additional revenue through cross-selling opportunities. Universal Shield’s Joe Alessi, surety division manager, said “we identified a gap in […]

DUBLIN, OHIO – March 21, 2024 – Universal Shield Insurance Group (Universal Shield) is pleased to announce the opening of its fourth corporate operations office located at 15 South Main Street in Marengo, Ohio (Northeast of Columbus). Universal Shield’s other offices are located in Dublin, Ohio (Suburban Columbus); Hudsonville, Michigan (Suburban Grand Rapids); and Waterford, Michigan (Suburban Detroit). The company intends to hire upwards of 40 positions throughout 2024 and 2025 in the newly renovated facility. The office currently includes 12 cubicles, a staff kitchen, executive office space, and significant space to expand with more cubicles and individual offices when […]

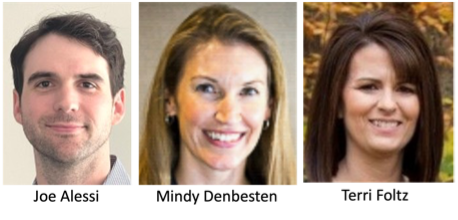

DUBLIN, OHIO – January 31, 2024 – Universal Shield Insurance Group (Universal Shield) is proud to announce that three of the company’s executives have been designated as 2024 emerging industry leaders by the American Property Casualty Insurance Association™ (APCIA), AM Best®, and Insurance Careers Movement. Universal Shield’s Joe Alessi, Surety Product Manager; Mindy Denbesten, Associate Controller & Business Intelligence Analyst; and Terri Foltz,Director of Binding, have been selected for this honor which recognizes high performing insurance industry employees who make high value contributions to their company, their community, and are exceptional developing leaders in the industry. Honorees are invited to attend […]

Universal Shield Insurance Group Enters Commercial Excess Liability Insurance Market WATERFORD, Michigan – March 27, 2023 – Universal Shield Insurance Group (Universal Shield) is proud to announce a new product offering – Commercial Excess Liability insurance. This introduction brings stable capacity to the marketplace for this niche line of coverage which in recent years has seen numerous other carriers reduce available capacity and restrict coverage scope and features. Universal Shield’s Antoinette Hardy-Manyfield, vice president of excess underwriting, said “the last three years have been challenging for the insurance industry, with external factors such as social inflation and logistical supply chain […]

Universal Shield Insurance Group Enters Commercial Garage & Auto Dealers Insurance Market WATERFORD, Michigan – March 21, 2023 – Universal Shield Insurance Group (Universal Shield or Company) is proud to announce a new product offering – Garage & Auto Dealers commercial insurance. This product brings a needed stable carrier into this niche line of coverage which has seen significant marketplace capacity fluctuations in recent years. Universal Shield’s Lisa Daniel, vice president of garage underwriting, said “2021 and 2022 were years of significant disruption for the Commercial Garage & Auto Dealers insurance marketplace with three national excess & surplus (E&S) markets […]

Universal Shield Insurance Group Executives Named as 2023 Emerging Leaders by Major Insurance Industry Groups & AM Best® WATERFORD, Michigan – January 23, 2023 – Universal Shield Insurance Group (Universal Shield) is proud to announce that two of the company’s senior executives have been designated as 2023 emerging industry leaders by the American Property Casualty Insurance Association™ (APCIA), AM Best®, and Insurance Careers Movement. Universal Shield’s Lisa Daniel, vice president of garage underwriting, and Antoinette Hardy-Manyfield, vice president of excess casualty underwriting, have been selected for this honor which recognizes high performing insurance industry employees who make high value contributions […]

Explore how Technology and Operational Innovations are Being Leveraged to Enhance Commercial Insurance Solutions. AdvancementsTV with Ted Danson to educate about developments in state-of-the-art insurance technology.

Subsidiaries Universal Fire & Casualty Insurance Company and Shield Indemnity Both Rated A- (Excellent) by A.M. Best with Revised Financial Size Category of VII ($50 Million to $100 Million)

Universal Shield Insurance Group (Universal Shield) is pleased to announce that on January 26, 2022, A.M. Best assigned a Financial Strength Rating (FSR) of A- (Excellent) and a Long-Term Issuer Credit Rating (Long-Term ICR) of “a-“ (Excellent) to Universal Fire & Casualty Insurance Company (UFCIC) and its wholly owned subsidiary, Shield Indemnity, Inc. (Shield). A.M. Best assigned both ratings a stable outlook.